What are the conditions for purchasing and importing gold bars from the Gasil Kalay?

First, contract preparation, advance payment, delivery under a formal contractHow to import gold bars?

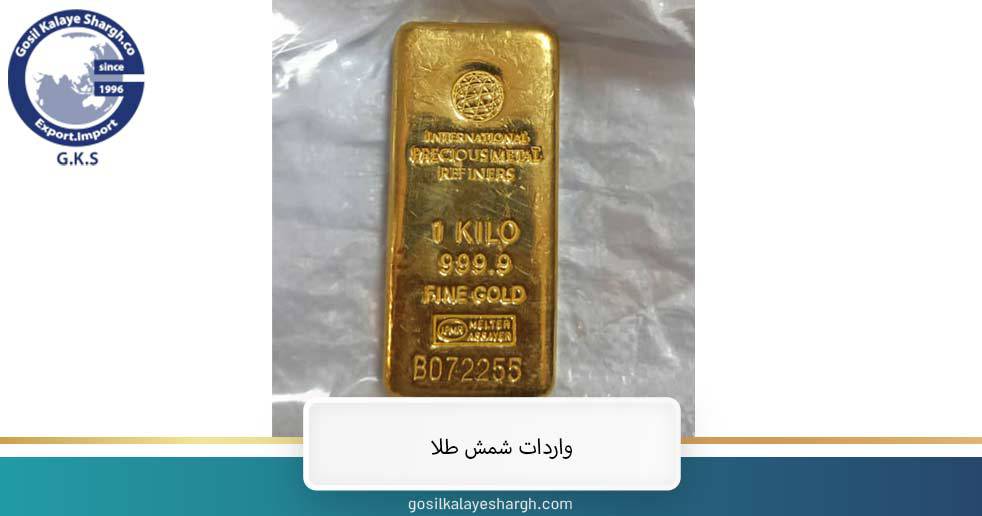

Gold bars must be cleared in a minimum weight of one kilogram through customs declaration after completing customs formalities.How is the cost of importing gold bullion calculated?

It is calculated from the source of the world price of ounce and the daily rate of the dollar.How long is the delivery time for gold bars?

Depends on the country of origin. UAE 3 days - Germany 10 days - Africa 2 weeks

Gold bullion is the most popular type of gold to hold as an investment because it is generally easy to sell and holds its value well. The import of gold bars to Iran by natural or legal persons is allowed in any amount for commercial or non-commercial use and it will be in the form of standard bars and according to all relevant laws and regulations. According to the decision of the Central Bank on February 9, 1401, several facilities have been provided for the import of gold to the country, which has doubled the attractiveness of this industry for individuals and businessmen.

Gold bar import conditions

The rules for importing gold bullion in Iran are such that the Central Bank of the Islamic Republic of Iran can grant permission to Iranian banks to import gold. Banks cannot commit to sell gold for an amount higher than the set rate. The total value of the gold assets of any Iranian bank should not normally be more than ten percent of the allocated reserve capital of that bank, except in special circumstances and with the approval of the Central Bank of the Islamic Republic of Iran, this can be done. Also, gold imported by banks must be in the form of bullion and have the standard marks of international assayers accepted by the Central Bank of the Islamic Republic of Iran.

In order to control the gold market and also to know the amount and manner of importing gold bars to Iran, declaration forms are prepared by the central bank and are provided to the Iranian customs. Customs should be ready, this form is in three copies and they send one copy of this information regularly to the Islamic Central Bank of the Republic of Iran. The export of objects made with any amount of gold, by natural or legal persons, is allowed by the Central Bank of the Islamic Republic of Iran, but the export of gold bars and coins is prohibited in any form. Unless it is done by the Central Bank of the Islamic Republic of Iran.

In the law of Iran, this regulation as well as the regulations issued by the Central Bank of the Islamic Republic of Iran regarding the import and export of gold are fully observed. Real and legal exporters of gold items are obliged to settle their obligations. This means that by importing the same amount of metals exported in standard forms, the amount of the considered reserves of the country will be placed in the specified range. Like other imported and exported foreign exchange goods that are sold by individuals to the Central Bank, gold bars can also be sold to the Central Bank of the Islamic Republic of Iran.

Import services of gold bars

From long ago to today, gold is not only used as jewelry, but also an important and influential factor in the country’s economy. Like foreign exchange reserves in the country, gold reserves are also very important. In order to regulate the market, the Central Bank of the Islamic Republic of Iran can import gold directly or through the banking system, as well as buy and sell this metal. According to the facilitated conditions of import listed in Articles 12 and 24 of the Export and Import Law of the Islamic Republic of Iran, import is possible especially for companies with valid licenses and on the condition of preserving the country’s reserves and gold. The purpose of these laws is to increase the import of gold in order to increase the country’s gold reserves.

It should be noted that to import gold bars, you can import gold through reputable trading and importing companies. The East Goods Forwarding Trading Company has more than 20 years of experience in the field of trading services, so you don’t even need to travel to another country to import gold bars, and all the steps from purchasing gold bars to packaging and shipping the shipments, as well as obtaining the necessary permits from customs, will be carried out by the East Goods Forwarding Trading Company.

Import of gold bars to Iran

Importing gold from countries such as the Emirates, Switzerland and Germany is very beneficial for the economy of our country, Iran, from an economic perspective. The main reason for this is the country’s gold and foreign exchange reserves. In order to achieve this goal, the rules and regulations related to the import of raw gold are very simple and feasible, and only require obtaining a license from the Central Bank and a number of customs licenses. For this purpose, people who work in the field of gold import will be exempted from the remaining import-related costs. The Emirates has become one of the best places to buy precious metals. The Emirates is a city known for having the most distinctive gold markets in the world.

Gold prices in the UAE are based on international gold values, which ensures consistent pricing in every store As gold prices in Iran continue to fluctuate, gold buyers in the UAE may benefit from lower prices and import gold bullion from the UAE. they can buy gold at the lowest possible rate Also, the laws of the UAE have been greatly simplified to export gold to other countries Gold export is the second most profitable export business after oil export in this city

This issue, along with its proximity to Iran and the low cost of transportation, has made the profit of importing gold from the UAE to be significantly high for gold importers. Switzerland also accounted for 22.6% of total global gold imports in 2022 and was the world’s largest gold importer by value. Gold bars are produced with a minimum grade of 955 and a maximum grade of 999.99. In fact, the ingots that are designed and produced in Switzerland are commonly known as Swiss ingots.

Among gold artefacts, bars have the highest level of purity, and among different bars, Swiss bars usually have higher purity. In this regard, importing gold bars from Switzerland can be an ideal option. According to the Central Bank’s decision on 9 February 1401, the conditions for importing gold in Iran have been greatly facilitated.

Based on this, the requirement to open a letter of credit for gold import was removed, and from now on, importers can import gold using all methods and means of payment. At the same time, the restriction on the use of the currency restrictions that existed for gold importers was removed and the use of these resources obtained from the export of others or for the import of gold was provided, which is a very good opportunity for gold importers.