Incoterms

Incoterms or international commercial terms (International Commercial Terms) includes a predefined set of commercial terms published by the International Chamber of Commerce in relation to international commercial laws. These terms are widely used in international trade transactions and are encouraged by commercial agents, courts, and international lawyers. The Incoterms rules were originally created with the aim of simply transferring the duties, costs, and risks associated with the international transport and delivery of goods, and consist of a set of 3-word commercial terms.

- determine the limits of the parties’ responsibility;

- The costs of both parties determine the contract;

- specify possible commercial risks between the buyer and the seller; And

- They prevent disputes caused by misinterpretation of terms used in commercial contracts.

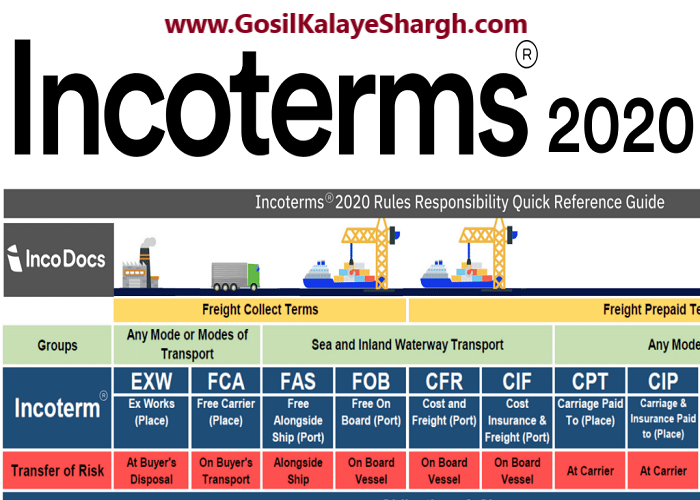

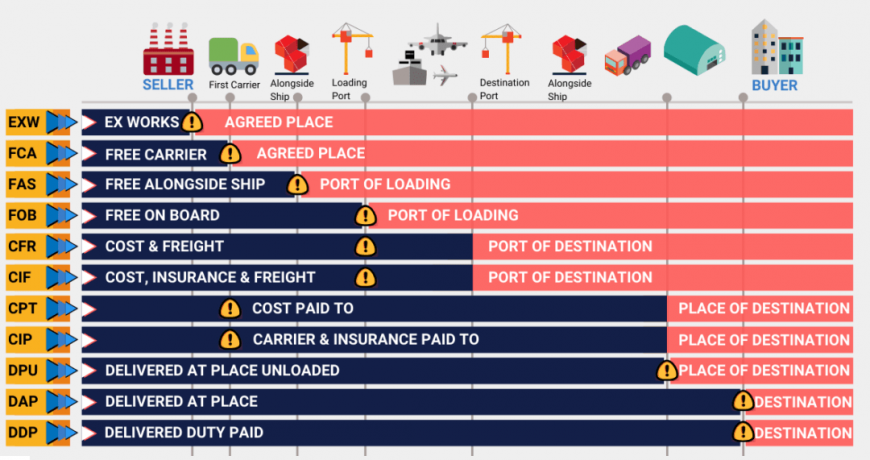

In other words, the rules of Incoterms have entered various fields of commerce such as transportation of goods, clearance of goods, export, import, determination of responsibility for payment and determination of the risk of transportation of goods in different stages of goods transfer. Terms defined in Incoterms Some terms in Incoterms have different meanings. Incoterms terms are divided into two main categories:

- Incoterms terms suitable for all types of shipping methods

- Incoterms terms suitable for sea freight and shipping

In the following, before introducing Incoterms terms suitable for all types of transportation methods, especially sea transportation, we will introduce very important general concepts in it. Some of the most important Incoterms terms include:

- Delivery: is the point in the transaction where the risk of loss or damage to the goods is transferred from the seller to the buyer.

- Arrival: or delivery, the point at which shipping is paid.

- Free: The seller undertakes to deliver the goods to the point from which they are shipped.

- Carrier: Any person who, in a contract of carriage, undertakes the duty of carriage by train, road, air, sea, river or a combination of these methods.

- Freight Forwarder: A company that contracts or participates in a freight contract.

- Terminal: any covered or non-covered place such as warehouse, parking lot, container garage or road, rail, or air cargo terminal.

- To clear for export: receiving an export clearance certificate and obtaining an export license.

What are the benefits of Incoterms rules? The rules of Incoterms include 11 main terms and a number of sub-terms, which have been set up by buyers and sellers to clarify the provisions of these rules as much as possible. That is why the possibility of misinterpretation and misunderstanding of these rules by each party has been significantly reduced. One of the most important advantages of Incoterms is that it answers many questions in various fields, including transportation and transportation issues, as well as related costs. For example, you can easily find answers to such questions by studying the rules of Incoterms:

- How long does it take to deliver a package?

- What are the shipping methods and conditions?

- How can you make sure that the standards set by both parties are met?

Although these laws are comprehensive and complete, it should be remembered that they also have their own limitations. In other words, there may be issues and questions that cannot be answered with the help of Incoterms rules. For example, these rules do not have any responsibility for the contractual rights and obligations between the buyer and the seller or even methods for breach of contract. Another advantage of Incoterms rules is to specify the trading party who is obliged to enter into a contract of carriage of goods or to provide cargo insurance coverage. In simpler words, these rules clearly define which party is responsible for paying such costs. Photo 16 Also, according to these rules, it is determined which of the parties should receive official permits, including export permits, and perform related administrative work. In this way, the expenses related to doing these works are also determined who is responsible so that there is no dispute between the parties of the contract. What are the disadvantages of not using Incoterms? Every trader or trader should update himself with the changes in Incoterms rules every year. In fact, these rules are set in the first place for the benefit of the businessman and help him to do business with the businessmen of other countries in a more convenient, safer way and with the least amount of disagreements. Not having proper knowledge of these rules can lead to waste of time and energy as well as huge financial losses in various fields including importing goods. Failure to use Incoterms rules can also cause problems in cargo delivery. In these rules, the seller’s obligation regarding the time and conditions of goods delivery are defined. As a result, merchants can refer to this section of the law to find out when they are able to receive damages from the seller. However, Incoterms also has limitations that are very important to know in correct use. First of all, you should remember that Incoterms is only part of the international trade agreement. Among the most important limitations of Incoterms rules, the following can be mentioned:

- Failure to mention the amount paid or payment methods used in transactions

- Not giving up official and mandatory rules

- Failure to mention the transfer of ownership of goods, breach of contract and product liability (in other words, failure to mention the type of ownership)

- These terms cannot be used instead of a formal contract between the two parties.

- Commodity insurance liability is not specified in any of the Incoterms terms except group C. As a result, the parties to the contract must be addressed separately.

Incoterms terms suitable for all types of transportation methods. Some Incoterms terms are relevant and applicable to all methods of transporting goods. These terms are used to specify the type of contract and describe the duties and obligations of the parties (buyer and seller) in the transaction process. In the following, we introduce the most important terms that are used for various methods of transporting goods. Photo 17 EXW – EX Works In this method, the name of a destination is placed after the expression EXW. The seller is obliged to deliver the goods to this destination. This term creates a maximum obligation on the buyer and a minimum obligation on the seller. Often, this term is used for an initial price quote without calculating any additional costs. The term EXW means that a buyer assumes the risks of getting the goods to their final destination. If the seller does not load the goods or does not obtain their clearance for export, or does not load the goods, in any case the risk and cost is with the buyer. If the parties agree that the seller must load the goods and send them to a certain point in order to share the risk, this agreement must be clearly recorded in precise words to give effect to this type of contract. Photo 18 FCA – Free Carrier In this method, the seller delivers the goods to the buyer at a specific location with export clearance. The goods may be delivered to a carrier nominated by the buyer, or to another party specified by the buyer. This international trade term has in many ways replaced the term FOB in new uses. This term used to mean the delivery of goods at a port or place of shipment, which has become a geographic destination in FCA terminology. Only the point of transfer of risk in this term has changed from the port to the point or place of delivery of the goods. The place chosen in this type of contract has a significant impact on the obligations of loading and unloading goods. If delivery is part of the seller’s obligations, or is made at any place under the seller’s supervision, he will be responsible for loading the goods on the buyer’s carrier. But if the delivery is done at any other point, upon reaching the destination, the responsibility of delivering the cargo is removed from the seller, thus the buyer is responsible for emptying the cargo and filling it in the buyer’s carrier. CPT – Carriage Paid To In this method, the seller assumes the cost of transporting the cargo to the named destination. In this method, when the goods are loaded in the first carrier, the risk of the goods is transferred from the seller to the buyer. In this method, the seller is responsible for the initial costs, including export clearance and shipping costs to the named destination. It does not matter whether this point is the final destination or one of the ports of the seller’s country, in any case, this place must be mentioned in the contract. If the buyer requires the seller to provide insurance for the cargo, then the Incoterms term CIP should be used in the contract instead. Photo 19 CIP – Carriage and Insurance Paid To This term is very similar to CPT, with the difference that the seller undertakes to insure the goods in transit. In this method, the seller must insure the cargo up to 110% of its declared value according to international insurance rules. This should be done in the same currency used in the contract and should be agreed upon by the buyer, seller, and anyone else who benefits from the insurance. The CIP rule can be applied to a variety of shipping methods. DPU – Delivered at Place unloaded This Incoterms term indicates that the seller must unload and deliver the goods at the named destination. In this method, the seller pays all the cargo costs (export rates, transportation, cargo unloading from the carrier at the desired destination or terminal, and destination costs) and assumes all risks until the cargo reaches the specific point mentioned in the contract. This terminal may be a port, airport, or an inland transshipment terminal, but it must be capable of receiving cargo. All costs after unloading (for example, import fees, taxes, customs, and freight) are the responsibility of the buyer. It should be noted that any kind of delay costs at the terminal are often borne by the seller. DAP – Delivered At Place In Incoterms 2010, the term DAP for “delivered at place” is defined as follows: the seller delivers the goods to the buyer at the named destination ready for unloading. According to the term DAP, the risk of freight is transferred from the seller to the buyer when the goods arrive at the place specified in the contract. As soon as the goods are ready for shipment, the necessary packaging is done by the seller at his own expense, and in this way the goods reach their destination safely. All necessary legal formalities in the country to which the goods are exported are carried out by the seller at his expense, and the risk of the goods being cleared or not is also borne by the seller. Photo 20 After the goods arrive at the destination country, the customs clearance of the goods and all related documents must be done by the buyer. According to the terms of DAP, all transportation costs and terminal costs are paid by the seller until reaching the agreed destination. The buyer is responsible for the cost of unloading the cargo at the final destination. DDP – Delivered Duty Paid In this method, the seller is responsible for delivering the goods to the named place in the buyer’s country, and pays all the costs until the goods arrive at the destination, including customs and import duties and related taxes. In this way, the seller is not responsible for unloading. In this method, the maximum duties are the responsibility of the seller and the minimum duties are the responsibility of the buyer. No risk or responsibility is borne by the buyer until the cargo reaches the specified point. The most important point in Incoterms DDP is that the seller is responsible for clearing the goods at the customs of the buyer’s country, and this includes paying the related costs and performing legal procedures and providing the necessary documents. For this reason, if the seller is not familiar with the import laws of the destination country, this method can be very risky for him and cost him a lot of money. The difference between Incoterms 2010 and Incoterms 2020 As mentioned earlier, Incoterms rules are updated every so often. As a result, all traders and merchants should familiarize and update themselves with the latest Incoterms rules. In this way, there are differences between Incoterms 2010 and Incoterms 2020. In this section, we will pay attention to the differences between these rules and the rules of Incoterms 2010 and Incoterms 2020. Changes to the domestic waybill rules in Incoterms FCA container shipping in the Incoterms 2010 rules are specified by FOB. The problem arose when the seller no longer has any responsibility in this regard as soon as the container arrives at the export port, while the seller is responsible for all risks and costs. In the Incoterms 2020 rules, an option was added for the seller to receive the bill of lading so that there are no more risks such as unforeseeable cancellation of the shipment. A more precise mention of costs. The second difference between Incoterms 2010 and 2010 rules is in the costs section. The fees were listed separately in the Incoterms 2010 rules. It is the same in Incoterms 2020 rules; with the difference that A9 is intended for the seller and B9 for the buyer. A list of seller and buyer fees is specified. Change of insurance in CIP and CIF Insurance in CIF is fixed and is considered along with seller’s cost. In the CIP of Incoterms Rules 2020, the seller is obliged to pay insurance and cover all risks. Use of personal transport in FCA, DAP, DPU and DDP In the rules of Incoterms 2020, you are given the possibility to conclude the transport contract without the intervention of a third party and use your own means. Considering the safety requirements due to the importance of safety requirements in transportation, more attention has been paid to this issue in the rules of Incoterms 2020. In other words, Incoterms 2020 directly mentions obligations and costs related to safety. Change DAT to DPU DAT refers to delivery at the terminal while DPU refers to delivery at the final destination of discharge. The update has changed DAT to DPU. In other words, delivery of goods can be done at any place including the terminal from now on. Explanatory notes for users In Incoterms 2020, a series of explanatory notes for users are intended to clarify the correct legal path and better conditions for making trading decisions. Review of the latest available Incoterms The Incoterms 2020 rules deal extensively with the issue related to transportation between the seller and the buyer. Some of the most important issues considered in these rules can be mentioned the transportation of goods, clearance of goods, import and export of goods, responsible for payment, handling and transfer of goods. The terms used in the existing Incoterms rules are usually used by mentioning geographical areas and the titles related to relocation do not play a big role in these terms. Photo 21 The rules of the latest available Incoterms include the following, each of which is briefly explained.

- Risks: Based on existing Incoterms, the time of goods transfer from the seller to the buyer can be specified. In addition, Incoterms specifies which of the contracting parties (the seller or the buyer) is responsible for the potential risks of transporting goods.

- Costs: As mentioned in the previous sections, Incoterms 2020 specifies which of the parties to the contract (buyer or seller) is responsible for paying the costs. One of the most important of these costs is related to the insurance of the transported goods, the payment of which must be specified based on the existing Incoterms.

- Duties and Responsibilities: In general, existing Incoterms rules and regulations determine the duties and responsibilities of each party to the contract (buyer or seller). Among the most important of these duties and responsibilities, we can mention insurance and obtaining licenses for export and import, transportation and logistics.

The way of applying the existing Incoterms rules and regulations in using these rules and regulations should pay attention to three very important points:

- You must be fully informed about the existing Incoterms rules. These rules are the same in all export and import contracts and their compliance is considered very necessary.

- First of all, the Incoterms rule (for example, the use of the CIF rule) must be clearly defined by both parties to the contract.

- One of the most important points is to specify the name of the port or place where the goods will be delivered. In mentioning this issue, both the buyer and the seller of goods should be very careful.

Final word In this article, you learned from the website of Company “Gasil Kalai Sharq” that international trade terms or Incoterms are a set of rules and methods defined in trade and import and export of goods, which are compiled and updated by the International Chamber of Commerce. These terms are pre-defined terms that can be used to reduce the ambiguities in the duties of the trading parties to the minimum possible. Some of these terms are applicable and used in all modes of transportation. Meanwhile, some of these terms are used in specialized fields of transportation. In this article, while introducing the main terms in Incoterms, we introduced the most important procedures and terms that are used in all transport companies.